by | ARTICLES, ECONOMY, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Jeffery Anderson over at The Weekly Standard took a peek at Obamacare’s initial projected enrollment numbers and compared them to the current actual figures. What he found was that Obamacare is not as widely successful as the rosy Congressional Budget Office (CBO) estimates from 2010.

“Given that Obamacare’s supporters like to take the Congressional Budget Office’s overly optimistic scoring of the president’s signature legislation as gospel, it’s fun to look at how poorly Obamacare is actually doing in relation to earlier CBO projections. When the Democrats rammed Obamacare through Congress in 2010 without a single Republican vote, the CBO said that the unpopular overhaul would lead to a net increase of 26 million people with health insurance by 2015 (15 million through Medicaid plus 13 million through the Obamacare exchanges minus 2 million who would otherwise have had private insurance but wouldn’t because of Obamacare).

Fast-forwarding five years, the CBO now says that Obamacare’s tally for 2015 will actually be a net increase of just 17 million people (10 million through Medicaid plus 11 million through the Obamacare exchanges minus 4 million who would otherwise have had private insurance but won’t, or don’t, because of Obamacare).

In other words, Obamacare is now slated to hit only 65 percent of the CBO’s original coverage projection for 2015.

Obamacare’s under-publicized failure on this key point is attributable to a variety of factors, including but not limited to the following: People aren’t thrilled with Obamacare-compliant insurance’s high cost and limited doctor networks, and some would even rather pay a fine for refusing to buy such insurance than pay its premiums; the Supreme Court ruled that part of Obamacare was unconstitutional, thereby giving states more freedom not to help expand it; and HealthCare.gov has been more reminiscent of DMV.org than of Expedia.com.

In addition (and just as the CBO originally projected), the bulk of Obamacare’s net coverage gains are coming from dumping people into Medicaid (59 percent of the current projected net increase in 2015), not from getting people enrolled in private insurance (41 percent). Of course, President Obama rarely if ever talks about that aspect of Obamacare — but Republicans should.”

Desperate to get more people enrolled too, the Obama Administration announced last month another “special enrollment period” around tax time this year, to allow those who found out they have to pay a penalty/tax/fee instead of having insurance in 2014, the opportunity to not make the “mistake” again.

Those who opted not to have insurance in 2014 are fined $95, or 1% of their income, whichever is greater, which they pay when then file their 2014 taxes this year. In 2015, the fine increases to $325 or 2% of income. Enrollment in the special enrollment period has been lackluster so far.

The Administration just doesn’t seem to get that many people still don’t think Obamacare to be such a great piece of legislation, and certainly aren’t tripping over themselves to purchase an Obamacare plan.

by | ARTICLES, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

During oral arguments of the Burwell Obamacare case before the Supreme Court on Wednesday, a possible resolution seemed to rear its ugly head when Chief Justice Roberts questioned U.S. Solicitor General Donald Verrilli over the contested ambiguity of the application of Obamacare subsidies. Verrilli made the case that the “court should defer to the interpretation of the Internal Revenue Service, which said the tax credits apply nationwide.” This reasoning is absolutely the worst possible solution — but of course not entirely unexpected from the federal government.

The idea of “deference” refers “ to “Chevron deference,” “a doctrine mostly unknown beyond the halls of the Capitol and the corridors of the Supreme Court. It refers to a 1984 decision, Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc., and it is one of the most widely cited cases in law. Boiled down, it says that when a law is ambiguous, judges should defer to the agency designated to implement it so long as the agency’s decision is reasonable.”

Given the current catastrophic state of the Internal Revenue Service, the courts must run from this idea as quickly as possible. The IRS has proven overwhelmingly in the last few years that no decision it makes is “reasonable” and therefore cannot be trusted as an unbiased, independent agency capable of carrying out a professional opinion on this or virtually any manner. IRS officials engaged in targeting of conservatives, “lost” official emails, mislead Congress and investigators about their existence, and corresponded with agencies such as the FBI, the House Oversight Committee, the DoJ, and the White House in 2509 documents over a multi-year period.

No wonder the federal government requests deference to the IRS to sort out the language and spirit of Obamacare subsidies. It’s like the fox guarding the hen house!

The IRS is no more capable of making such a determination in the first place as the FCC was in implementing net neutrality or the EPA rules changes on limiting carbon dioxide emissions. Agencies have repeatedly exceeded their statutory jurisdiction. SCOTUS would be wise to ignore this suggestion to put the onus back on the IRS to sort out the mess. The IRS has never answered satisfactorily for its repeated scandals, and therefore cannot be considered non-partisan or capable of any prudent judgment, via “deference”, at this time.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Yesterday it was reported that the Treasury Department paid $3 billion to cover Obamacare cost-sharing subsidies without Congressional approval. The heart of the dispute appears to be whether or not these subsidies were supposed to be funded via yearly appropriations or not. The House Ways and Means Chair, Paul Ryan, argues the former. Health and Human Services, via the Department of Justice, argues the latter.

In order to make sense of the funding dispute, it seemed necessary to dig around in the agency budgets to see how cost sharing was accounted for. Cost-sharing falls under the purview of the “Centers for Medicare & Medicaid Services (CMS)”. Yet, while comparing the budget requests for 2014 (for which the Treasury covered costs) and the ones for 2015 (current) & 2016 (future), it became clear that CMS changed the way it accounted for cost-sharing funding after 2014.

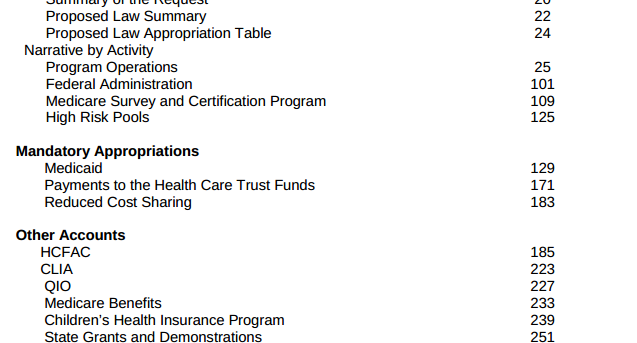

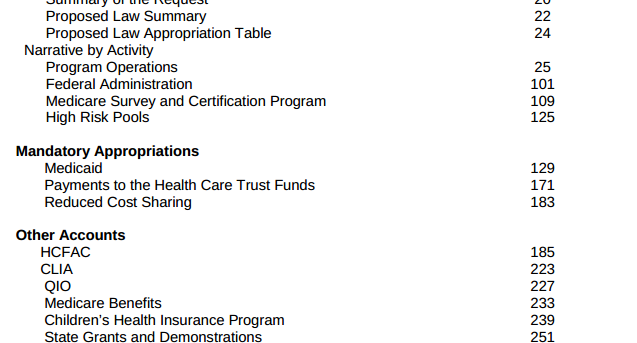

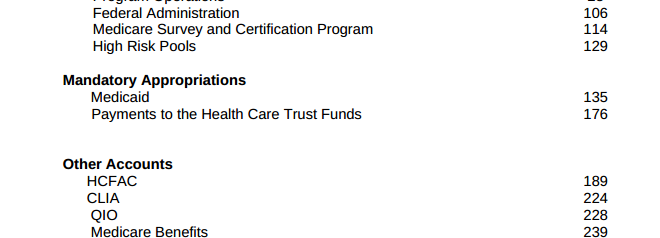

Looking at the 2014 Budget request, CMS had section called “Mandatory Appropriations”, which listed three items: 1) Medicaid 2) Payments to the Health Care Trust Funds 3) Reduced Cost Sharing.

Further in that budget, CMS wrote, “The FY 2014 request for Reduced Cost Sharing for Individuals Enrolled in Qualified Health Plans is $4.0 billion in the first year of operations for Health Insurance Marketplaces, also known as Exchanges. CMS also requests a $1.4 billion advance appropriation for the first quarter of FY 2015 in this budget to permit CMS to reimburse issuers who provided reduced cost-sharing in excess of the monthly advanced payments received in FY 2014 through the cost-sharing reduction reconciliation process.”

This position — that Obamacare cost-savings was to be funded by yearly appropriations– was reiterated by a “July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.” (Remember, a 2014 budget would have been written also in 2013)

You can see a picture of the 2014 budget here:

However, Congress rejected those requested appropriations at the time so “the administration went ahead and made the payments anyway.” That is the mystery $3 billion paid for by the Treasury.

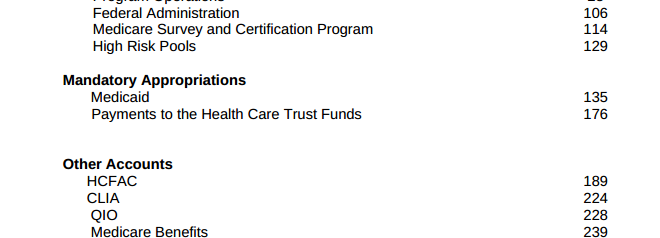

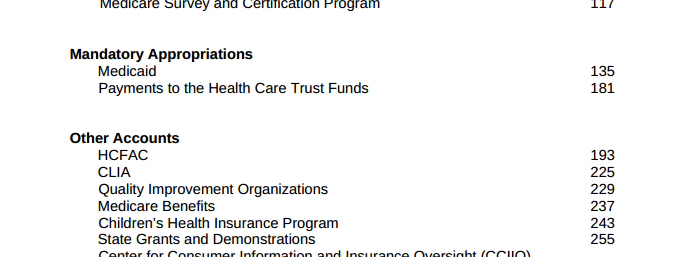

There is a noticeable change, however, with the CMS budget for 2015. The cost-sharing portion, which was originally listed as “Mandatory Payments” in 2014, is not listed at a “Mandatory Payment” anymore. Nor is it for 2016 either.

2015 Budget request:

CMS Budget 2015

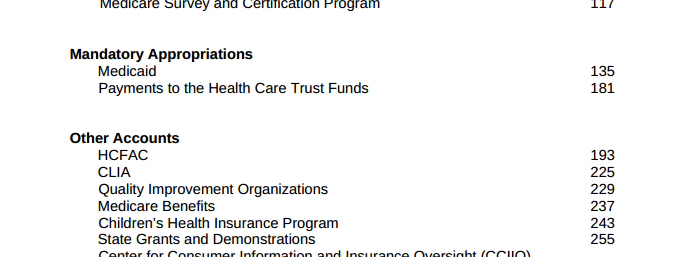

2016 Budget request:

CMS Budget 2016

Reading through the 2015 and 2016 budget documents, “cost sharing” appears in various areas, usually related to Medicaid, but not in one specific section — contrary to how it was accounted for in 2014, as a specific appropriation from the agency.

What’s equally interesting is that the DoJ argued about this specific matter in their recent brief dated January 26, 2015, saying that, “The House’s statutory arguments are incorrect. The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated. See 42 U.S.C. § 18082. With respect to Section 4980H, Treasury exercised its rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute. See 26 U.S.C. § 7805(a).”

Yet, as shown above, the “mandatory program for cost-sharing”, that was submitted for funding (and rejected) in 2014, was removed entirely from the 2015 and 2016 budget requests. Now there is no way to even see the “cost-sharing” portion of the budget at all. And this appears to contract the statement by the DoJ that there is a “mandatory payment” program.

Cost sharing subsidies are an enormous part of Obamacare. “These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.”

Cost sharing is expected to cost taxpayers roughly $150 billion over the next 10 years, according to estimates by the Congressional Budget Office.

But we now don’t know the specific funding amounts for the year 2015 or for 2016, and the costs for 2014 are in dispute, involving that $3 billion in funds from the Treasury (which came from somewhere and somehow).

The one thing we do know for certain: the Treasury Department is clearly exercising the power it perceives to have, as a “rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute.”

by | ARTICLES, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

A few weeks ago, I reported how Obama’s budget contained a $22 billion student loan bailout to cover a massive shortage of funds for the Department of Education Federal Student Loan program. Because the program is categorized as a “credit program”, due to a “quirk in the budget process for credit programs, the department can add the $21.8 billion to the deficit automatically, without seeking appropriations or even approval from Congress.”

Now it is being reported that the Treasury Department approved and paid for $3 billion in Obamacare costs without seeking Congressional approval. Have we uncovered another similar quirk in the federal budget process that allows for the Treasury to cover Obamacare costs that aren’t funded? We don’t actually know yet, because the letter from the Treasury which “revealed that $2.997 billion in such payments had been made in 2014”, “didn’t elaborate on where the money came from.”

Here’s what’s going on:

“At issue are payments to insurers known as cost-sharing subsidies. These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.

What’s tricky is that Congress never authorized any money to make such payments to insurers in its annual appropriations, but the Department of Health and Human Services, with the cooperation of the U.S. Treasury, made them anyway.”

So here we have two agencies collaborating on funding for Obamacare without Congressional approval. When asked about the $3 billion by House Ways and Means Chairman Rep. Paul Ryan, he received a letter which merely described the what the cost-sharing program was, without explaining anything 1) regarding how the payments came to be made, or 2) where the money came from.

What’s more, because the cost-sharing payments from the Department of Homeland Security is part of a larger lawsuit against Obama’s Executive Actions, filed by John Boehner, the letter referred Rep. Ryan to the Department of Justice.

It turns out that Department of Justice recently argued this topic on January 26th. In this brief the Department of Justice argued that John Boehner’s position, that the cost-sharing program payments required annual appropriation, was incorrect, “The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated.” So the Department of Justice and the Treasury Department and the Department of Health and Human Services maintain that the payment they made was licit and Congressionally approved as part of Congressional appropriations.

However, prior budget requests and negotiations tell a different story about how Obamacare cost-sharing is funded.

“For fiscal year 2014, the Centers for Medicare and Medicaid Services (the division of Health and Human Services that implements the program), asked Congress for an annual appropriation of $4 billion to finance the cost-sharing payments that year and another $1.4 billion “advance appropriation” for the first quarter of fiscal year 2015, “to permit CMS to reimburse issuers …”

In making the request, CMS was in effect acknowledging that it needed congressional appropriations to make the payments. But when Congress rejected the request, the administration went ahead and made the payments anyway.

The argument that annual appropriations are required to make payments is also backed up by a report from the Congressional Research Service, which has differentiated between the tax credit subsidies that Obamacare provides to individuals to help them purchase insurance, and the cost-sharing payments to insurers.

In a July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.”

As we are likely to not receive any answers soon regarding the $3 billion in Obamacare funding, or the source, here are some things to think about and look for as we wait:

1) How will cost-sharing be funded in this year’s budget?

2) Where did the $3 billion come from? If the $3 billion came from another agency, does that mean we have agencies who have large enough slush funds to absorb a $3 billion transfer?

3) If the $3 billion was tacked onto the deficit (like the student loan “bailout”), what does this bode for future cost-sharing payments? The Congressional Budget Office has already estimated that cost-sharing payments to insurers are expected to cost about $150 billion over the next 10 years.

by | ARTICLES, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

I’ve hinted that the Obama Administration and Democrats are now worrying about the backlash regarding the Obamacare penalty. This is the first year Americans who did not purchase health insurance will have to confront it on their tax bill. Byron York over at the Washington Examiner did a great job discussing the politics of the penalty as well as the new “special enrollment period” that will open up at tax-filing time.

“The Democrats who wrote and passed the Affordable Care Act were sure of two things: The law had to include a mandate requiring every American to purchase health insurance, and it had to have an enforcement mechanism to make the mandate work. Enforcement has always been at the heart of Obamacare.

Now, though, enforcement time has come, and some Democrats are shying away from the coercive measures they themselves wrote into law.

The Internal Revenue Service is the enforcement arm of Obamacare, and with tax forms due April 15, Americans who did not purchase coverage and who have not received one of the many exemptions already offered by the administration are discovering they will have to pay a substantial fine. For a household with, say, no kids and two earners making $35,000 a piece, the fine will be $500, paid at tax time.

That’s already a fact. What is particularly worrisome to Democrats now is that, as those taxpayers discover the penalty they owe, they will already be racking up a new, higher penalty for 2015. This year, the fine for not obeying Obamacare’s edict is $325 per adult, or two percent of income above the filing threshold, whichever is higher. So that couple making $35,000 a year each will have to pay $1,000.

There’s another problem. The administration’s enrollment period just ended on February 15. So if people haven’t signed up for Obamacare already, they’ll be stuck paying the higher penalty for 2015.

By the way, Democrats don’t like to call the Obamacare penalty a penalty; its official name is the Shared Responsibility Payment. But the fact is, the lawmakers’ intent in levying the fines was to make it so painful for the average American to ignore Obamacare that he or she will ultimately knuckle under and do as instructed.

Except that it’s easier to inflict theoretical pain than actual pain. Tax filing season is enlightening many Americans for the first time about the “mechanics involved” in Obamacare’s fee structure, Democratic Rep. Lloyd Doggett wrote to the Centers for Medicare and Medicaid Services on December 29. ‘Many taxpayers will see the financial consequences of their decision not to enroll in health insurance for the first time when they make the Shared Responsibility Payment.’

That is why Doggett, who has since been joined by fellow Democratic Reps. Sander Levin and Jim McDermott, asked the administration to create a new signup period for anyone who claims ignorance of the penalty. On Friday, the administration complied, creating a “special enrollment period” from March 15 to April 30.

To be eligible, according to an administration press release, people will have to “attest that they first became aware of, or understood the implications of, the Shared Responsibility Payment after the end of open enrollment … in connection with preparing their 2014 taxes.”

It’s not the most stringent standard: Just say you didn’t know. But even with that low bar, a significant number of Americans will decide not to enroll in Obamacare. For some, it’s the result of a financial calculation; paying the fine is cheaper than complying. Others are unaware. Maybe a few are just defiant.

Whatever the reasons, quite a few people will be hit with the penalty; Doggett and his Democratic colleagues subscribe to the Treasury Department’s estimate that somewhere between three million and six million Americans will have to pay the Obamacare penalty on the tax forms they’re filing now. Many will owe more next year, when the penalty goes even higher in 2016.

The individual mandate has always been extremely unpopular. In December 2014, just a couple of months ago, the Kaiser Family Foundation found that 64 percent of those surveyed don’t like the mandate. The level of disapproval has been pretty consistent since the law was passed.

And there’s very little chance the individual mandate’s approval numbers will improve, now that millions of Americans are getting a taste of what it really means. They’re learning an essential truth of Obamacare, which is that if you don’t sign up, the IRS will make you pay. No matter how much some Democrats would like to soften the blow they have delivered to the American people, that’s the truth about Obamacare.”