by | ARTICLES, ECONOMY, GOVERNMENT, OBAMA, TAX TIPS, TAXES

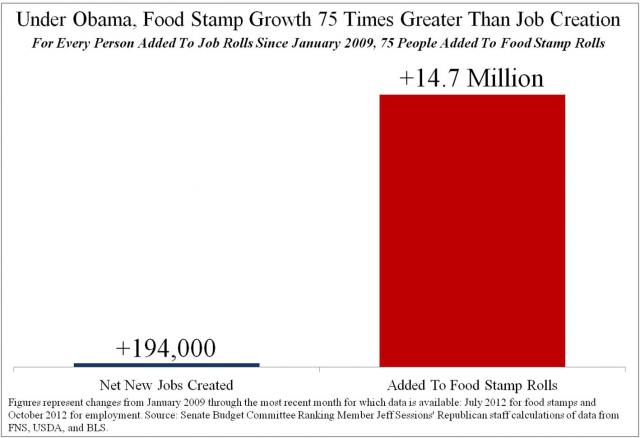

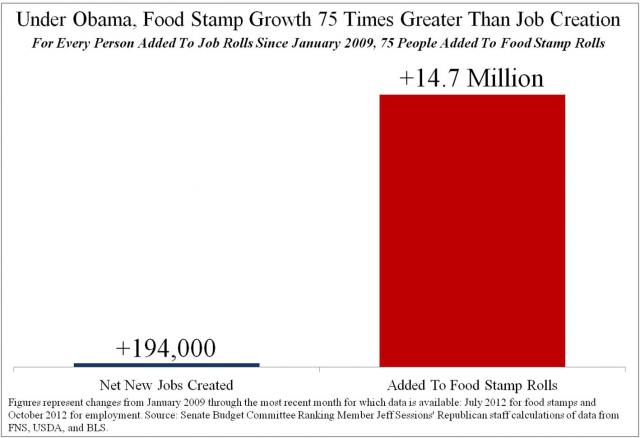

The Weekly Standard does a great analysis of the growth of food stamps in comparison to the growth of jobs during the Obama Administration. Using FNS, BLS and USDA data, they calculated that food stamp enrollment was 75 times faster than job creation. This visual puts it into perspective:

I have written on this trend before in the last few months; as unemployment has remained high, we recently passed the point where more people have been added to the dependency rolls than payrolls. This has a high impact on our crushing deficit and is directly attributable to Obama’s legacy. The article sums it up:

Welfare spending is projected to remain permanently elevated; for instance, at no point in the next 10 years will fewer than 1 in 9 Americans be on food stamps. In fact, the Administration has actively sought to boost food stamp spending and enrollment, including through a partnership with the Mexican government to advertise benefits to foreign nationals, as well as materials that teach outreach workers how to “overcome the word ‘No.’” USDA even goes so far as to argue that the program is “the most direct stimulus you can get.”

Overall, in the last four years, the United States’ gross federal debt has increased 53 percent, food stamp enrollment has increased 46 percent, and the number of employed persons has increased just 0.15 percent. This picture, however, is even more ominous than it looks. While only 194,000 net jobs have been created since 2009, the working age population has increased by approximately 5 million—almost 25 times that amount. In other words, a shrinking share of working age adults have or are even looking for a job. The real unemployment number (U-6), therefore, is 14.6 percent.

To put this month’s job creation in historical perspective, in October of 1984, 286,000 jobs were created—67 percent more—at a time when the U.S. working age population was 26 percent smaller than it is today.

Over time, these trends, if not reversed, spell economic disaster for the United States and its citizens.

Be sure to read the article in its entirety.

by | ARTICLES, HYPOCRISY, TAX TIPS, TAXES

So, Mitt Romney released his 2011 taxes. And on cue, Think Progress rolls out this inane hit piece entitled “By Romney’s Own Standard, His Tax Returns Would Disqualify Him From The Presidency”. The summary of their argument accuses Romney of paying more than his fair share of taxes this year. This implies that he is somehow gaming the system or dishonest.

However, this outrage — besides being just plain stupid — is entirely disingenuous. Why? Because in 2010, Romney actually DID pay more than his fair share of taxes, and when it was discussed in January after the release of his tax return, no media outlet said a word about it. I know this because I wrote about it.

Here’s the scoop:

I reviewed Romney’s returns for several different media outlets. In my article, and with discussion to the media, I pointed out this fact:

However, the most stunning information on his return is the fact that, due to inequities inherent our tax code, Romney paid taxes on more than a million dollars of income that didn’t exist.

The problem arises with regard to Romney’s hedge funds, and how he must record income and expenses:

From the income items, off comes the subtraction for interest. However, all of the other expenses that reduce profit – which, with hedge funds, include virtually all operation expenses to earn income, including fees to the operators – are required to be recorded as miscellaneous itemized deductions. You cannot deduct your share of expenses unless that amount exceeds 2% of your AGI. What’s worse, even if your expenses do exceed the threshold, and you are subject to the AMT you can’t deduct them at all. (Romney paid AMT).

This inability to deduct necessary expenses incurred while generating that income means that Mitt Romney paid taxes on $1.017 million of income that does not exist except on paper.

I went on to chronicle my exchanges with Bloomberg, NYDaily News, and CBS Evening News. None of them mentioned this. Out of curiosity, I even sent this off to Fox Business (remember — in January, Romney was not our nominee yet). Still, I received no reply. Then I saw some erroneous information coming out of the Boston Globe, and contacted the reporter for this story, who, after a basic exchange of emails, never followed up with me regarding hedge funds or the tax return analysis.

You can read the article from back in January 2012 in its entirety here.

So, back when Romney’s 2010 tax returns were released, the narrative then was that Romney didn’t pay enough in taxes, and therefore ignored a report that showed Romney did indeed pay his fair share — and then some.

The story picked up very little traction in early July, when Vanity Fair and Politico coordinated a financial smear on Romney. Jay Cost of the Weekly Standard, made mention of the summary of that fiasco, when I was pointing out the hypocrisy of media coordination when it fits a certain narrative.

So now the pendulum has swung. Instead of saying Romney paid too little in taxes, the Left wants us to be offended again but in the opposite vein. By claiming he paid more taxes than necessary — Romney is somehow hoodwinking us again.

He can’t be trusted and doesn’t pay enough taxes. He can’t be trusted and he pays too little taxes. Thus the new message: Romney can’t be trusted with finances at all.

No, the real problem is that we can’t trust the MSM.

Crossposted at RedState.com

Note: I have not had a chance to review Romney’s 2011 taxes to see if the same iniquity occurred. I will post an update when it gets done.

by | ARTICLES, TAX TIPS, TAXES

Itemizing on one’s taxes might take longer than taking the standard deduction, but the extra effort often pays off. NY1’s Money Matters reporter Tara Lynn Wagner filed the following report.

To itemize or not to itemize? That is the question… on line 40 of the 1040 form. Taxpayers get to choose between filing a Schedule A or taking the standard deduction, which is $5,700 for a single person and $11,400 for a married couple filing jointly. The standard deductions sound substantial, but itemizing may come up with more money.

“If your sum total of all your itemized deductions are going to exceed that number, you should itemize your deductions,” says Alan Dlugash, a partner of Marks Paneth & Shron LLP.

While $11,400 might sound high, it is actually a pretty easy threshold to reach. Experts recommend starting with big-ticket deductions like mortgage interest and then keep digging.

“You should have a simple list of the major items, and just do a quick ‘looksie’ to make sure,” says Dlugash.

“Personal taxes, taxes on your automobile, sales taxes are deductible as an option, if they’re bigger than your income taxes, which is also deductible; medical deductions,” says Mark Steber of Jackson Hewitt Tax Service.

One can also itemize charitable contributions, which range from clothes donations to support for a relief effort or contributions to the church collection bin. However, experts warn that those itemizations need proof.

“Anything — $10, $20, $30 — needs to be documented, so either a canceled check or you need to get a letter from the charitable organization showing you made this contribution,” says Vincent Cervone, the principal of VRC & Associates. “If you don’t have this letter, you cannot take this deduction.”

The important thing in general is to keep track of receipts, and there are many strategies for doing so. Those who want to use the least amount of effort can just toss their papers in a shoebox or manila envelope.

Cervone takes it one step further and recommends his clients get fancy supplies, like a notebook and a stapler.

“And each day you have a receipt for some sort of business expense, you staple it onto that page,” says Cervone. “At the end of the year when you come see me, I add all the pages up. I total it at the end of the year, and it’s done. It’s easy.”

It may not be as easy as taking the standard deduction, but experts say the bigger effort will likely mean a bigger refund.

“Standard’s easy. Itemized is hard, but itemized in many cases is much larger,” says Steber.

Click here to watch the video: http://brooklyn.ny1.com/content/ny1_living/money_matters/136150/don-t-agonize-when-it-comes-time-to-itemize