by | ARTICLES, BLOG, BUSINESS, CONSTITUTION, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, QUICKLY NOTED, TAXES

Bernie Sanders recently advocated for President Obama to raise $100 billion in taxes by the old “closing corporate loopholes” schtick. The difference this time, is that Obama is actively exploring his abilities to do so via Executive Order. Townhall has the scoop:

“White House Press Secretary Josh Earnest confirmed Monday that President Obama is “very interested” in the idea of raising taxes through unitlateral executive action.

“The president certainly has not indicated any reticence in using his executive authority to try and advance an agenda that benefits middle class Americans,” Earnest said in response to a question about Sen. Bernie Sanders (I-VT) calling on Obama to raise more than $100 billion in taxes through IRS executive action.

“Now I don’t want to leave you with the impression that there is some imminent announcement, there is not, at least that I know of,” Earnest continued. “But the president has asked his team to examine the array of executive authorities that are available to him to try to make progress on his goals. So I am not in a position to talk in any detail at this point, but the president is very interested in this avenue generally,” Earnest finished.

Sanders sent a letter to Treasury Secretary Jack Lew Friday identifying a number of executive actions he believes the IRS could take, without any input from Congress, that would close loopholes currently used by corporations. In the past, IRS lawyers have been hesitant to use executive actions to raise significant amounts of revenue, but that same calculation has change in other federal agencies since Obama became president.

Obama’s preferred option would be for Congress to pass a corporate tax hike that would fund liberal infrastructure projects like mass transit. But if Congress fails to do as Obama wishes, just as Congress has failed to pass the immigration reforms that Obama prefers, Obama could take actions unilaterally instead. This past November, for example, Obama gave work permits, Social Security Numbers, and drivers licenses to approximately 4 million illegal immigrants.

Those immigration actions, according to the Congressional Budget Office, will raise federal deficits by $8.8 billion over the next ten years.”

by | BLOG, ECONOMY, FREEDOM, GOVERNMENT, POLITICS, TAXES

“But how is this legal plunder to be identified? Quite simply. See if the law takes from some persons what belongs to them, and gives it to other persons to whom it does not belong. See if the law benefits one citizen at the expense of another by doing what the citizen himself cannot do without committing a crime.” ~ Bastiat’s “The Law”

![bastiat-quote-picture_thumb[2]](https://taxpolitix.com/wp-content/uploads/2015/02/bastiat-quote-picture_thumb2.jpg)

by | ARTICLES, ECONOMY, OBAMA, OBAMACARE, POLITICS, TAXES

As the Obamacare sign up season ended, some Democrats are concerned that there might be a kerfuffle at tax time when taxpayers who opted not to have health insurance coverage last year learn they have to pay a penalty-tax-fee. The penalty is officially called the “shared responsibility payment”.

Three Democrat officials have appealed to the Obama Administration to offer a special enrollment period at tax filing time.

This is the first year the penalty is levied. The penalty for the 2014 tax year is relatively cheap in order to transition Obamacare into American life. However, next year and in subsequent years, the penalty goes up swiftly. This is why some lawmakers are concerned, because the open enrollment period has ended, and those who still don’t have insurance will face steeper fines.

For not having health insurance last year, the fine is $95 per person or 1 percent of household income above the threshold for filing taxes, whichever is greater. But the fine increase to $325 per person or 2 percent of household income to be collected next year, for those who opted not to enroll in Obamacare or have health insurance at all.

This of course would be one of many tweaks to the law since it was passed in 2010. What Democrats are particularly worried about is the fallout of a massive tax penalty in 2016 — when the Presidential election campaigns are in full swing. The backlash is certain to be harsher next year, and even more so beyond, and the health law will be harder to defend and justify. According to government estimates, the average fine will be about $1,100.”

The White House remains uncommitted as to whether it will enact a small filing season around April 15th or consider having open enrollment next year be shifted or extended to include some or all of the tax season. Of course they’ll do whatever it takes to mask the consequences of Obamacare’s policies, again and again and again. If it was such a great piece of legislation, it should be able to stand on its own merit. But it wasn’t — and more and more people finally realize it.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

A few days ago, Politico revealed a little gem hidden in the Obama budget:

“In obscure data tables buried deep in its 2016 budget proposal, the Obama administration revealed this week that its student loan program had a $21.8 billion shortfall last year, apparently the largest ever recorded for any government credit program.”

That’s a nearly $22 billion loss — for one program, for one year. Politico described how that the amount is greater than the budgets of the EPA and Interior Department combined, or the NASA program’s budget. But it will be covered entirely by the taxpayer anyway.

How did the federal student loan program rack up such massive debt so quickly? Let’s take a look at Obama’s recent reform efforts and programs to help provide relief to student borrowers.

A 2010 law allowed for repayment caps at 10% of a borrower’s income, though some loan holders were initially ineligible. This was called “Pay As You Earn” (PAYE). There were also some other portions of PAYE that were less talked about by the media, including:

1) If the payment doesn’t cover the accruing interest, the government pays your unpaid accruing interested for up to three years from when you begin paying back your loan under the PAYE program.

2) The balance of your loan can be forgiven after 20 years if you meet certain criteria

3) Your loan can be forgiven after 10 years if you go to work for a public service organization

Obama then expanded the PAYE program in June 2014 via Executive Order. The NYTimes reported that this “extend such relief to an estimated five million people with older loans who are currently ineligible — those who got loans before October 2007 or stopped borrowing by October 2011. But the relief would not be available until December 2015, officials said, given the time needed for the Education Department to propose and put new regulations into effect”.

That recent expansion helped to figure into the staggering re-estimation listed in Obama’s FY 2016 budget. As far as the terms of the costs for just the PAYE program, those have “ballooned from $1.7 billion in 2010 to $3.5 billion in 2013 to an estimated $7.6 billion for 2014.”

What’s more, last June, CNS News reported a huge increase in overall student loan debt by comparing the balanced owed when Obama took office to the balance owed in May 2014:

“Since President Barack Obama took office in January 2009, the cumulative outstanding balance on federal direct student loans has jumped 517.4 percent. The balance owed as of the end of May was $739,641,000,000.00. That is an increase of $619,838,000,000.00 from the balance that was owed as of the end of January 2009, when it was $119,803,000,000.00, according to the Monthly Treasury Statement.”

Comparing that amount to his predecessor, under George W. Bush, “the amount of outstanding loans increased from $67,979,000,000.00 in January of 2001 to $119,803,000,000 in January of 2009, an increase of 76.2%.” That was over 8 years. Obama’s jumped the 517.4% in 5.5 years.

So how does this particularly enormous budget shortfall get resolved? Why, it simply gets tacked directly onto the federal deficit. Since the federal student loan program is considered a credit program, “because of a quirk in the budget process for credit programs, the department can add the $21.8 billion to the deficit automatically, without seeking appropriations or even approval from Congress.” This whopper adds nearly 5% to the deficit itself.

Apparently, this sort of bailout is not entirely uncommon either. According to a report last month on the U.S. Government credit-loan system,

“these unregulated and virtually unsupervised federal credit programs are now the fastest-growing chunk of the United States government, ballooning over the past decade from about $1.3 trillion in outstanding loans to nearly $3.2 trillion today. That’s largely because the financial crisis sparked explosive growth of student loans and Federal Housing Administration mortgage guarantees, which together compose two-thirds.“

The FHA itself has added $75 billion to the deficit in this manner over the last twenty years. Though that is a ridiculous sum itself, it makes the one year, $21.8 billion chunk for the federal student loan program bailout contained in Obama’s FY2016 budget especially egregious and alarming.

Like the ballooning student loan debt, the act of loan forbearance, which is a temporary pause in repayment of your federal student loan, has also seen an upswing. Forbearance can be granted for up to three years. According to the Wall Street Journal, “loan balances in forbearance were about 12.5% of those in repayment in 2006. In 2013, they were 13.3%. Today they are 16%, or $125 billion of the $778 billion in repayment.”

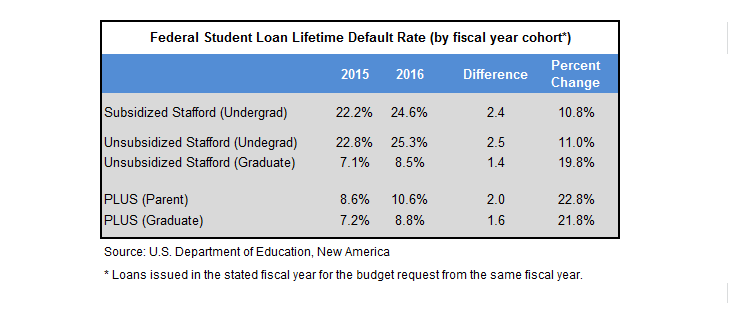

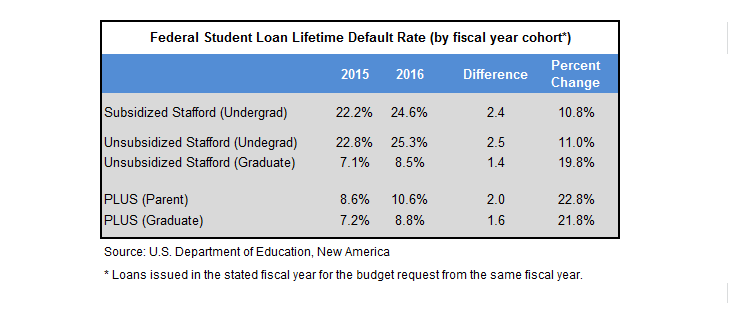

As for defaulting entirely, Forbes recently noted that, “the Department of Education’s budget documents project that 25.3 percent of undergraduate Stafford loans (measured by dollars, not numbers of loans) issued next year will default at some point during the borrower’s repayment term. That is up a full 2.5 percentage points from what the agency projected last year for the previous cohort of loans.” All categories of loans, according to the DoE projection, will see an increase in default.

These figures reinforce a WSJ opinion piece in late December covering the “student debt bomb”. The author, Jason Delisle, director of the Federal Education Budget Project at the New America Foundation, detailed how the current rate of default “now stands at 19.8% of borrowers whose loans have come due — some 7.1 million borrowers with $103 billion in outstanding balances.”

Trying to discern whether or not this $21.8 billion shortfall contained in Obama’s budget is a one-time anomaly or not remains to be seen. The sharp uptick of federal student loan debt and defaults in the past few years would suggest it is not. And there seems to be little incentive just yet to reign in Obama’s repayment reforms, since, at the end of the day, any loss will just be added onto the federal deficit for the taxpayer to pick up the tab — while the Feds continue to tout to young people how much Obama is helping them.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, TAX TIPS, TAXES

He’s a pretty smart guy….

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Obama’s budget for FY2016 claimed $1.8 trillion in deficit savings over a ten year period, 2016-2025. He used PAYGO (pay-as-you-go) rules to determine this figure, which basically means paring tax increases and spending reductions on one side to pay for new spending programs and tax credits on the other side, with anything left over going to the deficit.

However, his numbers for overall deficit reduction appear to be overstated, according to an analysis by the Committee For a Responsible Federal Budget (CRFB), by “using a baseline which effectively ignores the costs of extending or repealing certain policies and assuming a large increase in spending in the future to claim savings from extending spending limits after 2021.”

The Chicago Sun-Times did a decent summary of the CRFB report. Essentially, Obama makes a series of assumptions about future budget items to achieve his number for deficit reduction ($1.8 trillion), so that it comes close to the amount of tax hikes in the budget ($2 trillion), making it somewhat politically palatable — at least for his side. Here are the major points:

“MANDATORY AUTOMATIC CUTS

In the budget table summarizing the $1.8 trillion in deficit cuts, there’s a line that adds back funds to replace the automatic, across-the-board cuts to a variety of mandatory programs, including a 2 percentage point cut in payments to doctors who treat Medicare patients.

That’s a major assumption on Obama’s part about the fate of the automatic cuts, part of the deal he struck with Congress in August 2011.

Cost: $185 billion over 10 years.

MEDICARE FEES

There’s a proposal to permanently fix a flawed Medicare formula that threatens doctors with an even bigger 21 percent fee cut. Lawmakers typically “patch” the formula for a year or two but hope for a long-term solution this year.

Cost: $108 billion.

REFUNDABLE TAX CREDITS

A set of refundable tax credits — tax refunds that go out to low-income people who don’t owe federal income tax — expire in 2017. So does a maximum $2,500 tax credit for the cost of college. Obama’s budget simply assumes they get extended.

Cost: $166 billion.

INFLATED SPENDING BASELINE

This one’s tricky and requires background. Under budget rules, official scorekeepers at the Congressional Budget Office are supposed to set an arbitrary baseline for annual agency budgets passed by Congress each year that rises each year with inflation at a relatively generous pace.

The 2011 Budget Control Act slashed this spending increase by $900 billion by setting spending “caps” well below this baseline. Well, the caps are lifted after 2021, but Obama’s 10-year budget covers four more years. The White House assumes the baseline would jump to inflated levels that pretend the 2011 law never happened. Then it claims huge savings when cutting them back in 2022-25 to more realistic levels.

Questionable savings: about $310 billion.

DEBT SERVICE

Additional debt would have to be issued to cover the above policies, and interest costs on that debt are considerable. Cost: about $105 billion

GRAND TOTAL: $874 BILLION

In summary, Obama’s budget claims $1.809 trillion in deficit savings. Take away $874 billion accruing from accounting tricks and there’s about $935 billion left.”

There you have it. $935 billion is vastly different than $1.8 trillion — essentially saving only half of what Obama claims. For those who want to get into the nitty-gritty, you can read the full CRFB analysis here.

The government is always playing around with numbers and accounting tricks. Here are past examples of fuzzy math for Social Security gimmicks, Obamacare deficit scoring, and boosting Obamacare enrollment numbers. So this latest one is anything but surprising.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama proposed his FY2016 budget on Monday. The budget is filled tax hikes — more than 20 — which are expected to fund more spending schemes cooked up by the President. The tax hikes total about $2 trillion in additional revenue over the next decade. “The administration contends that various spending cuts and tax increases would trim the deficits by about $1.8 trillion over the next decade, leaving the red ink at manageable levels.”

So, just like his yearly spending, so to with his decade budget outlook: despite record tax revenue, Obama’s proposals still don’t balance out. We continue to have deficit spending.

What is in this budget proposal? It’s chock-full of ambitious taxes aimed mainly at the wealthy and businesses. Most of his budget items will likely not pass Congress — and he knows this. At this point in his Presidency, it doesn’t matter anyway what he proposes, or really, what actually passes. And Obama knows this. He’s not running again.

Obama has merely given the Democrats a list of initiatives for them to push, so that they can create anti-Republican narratives using his ideas for litmus tests and sound bytes over the next year to two years heading into the 2016 elections. It’s not about solutions; it’s about creating more divide. Charles Krauthammer got it right when he said, ““Look, I don’t mind if the President sends a budget which he knows is not going to achieve anything. But when he prefaces his remarks as we just saw by saying we have to put politics aside, posing again as the one person in the country who rises above partisanship and party, speaks for the national interest, it’s really grating.”

Here’s the rundown of the list of budget tax hikes. I’ll do some follow up posts about a couple of particularly odious policies contained therein, but for the time being, you can read the entire list of tax increases here. The amounts of revenue noted below are calculated to be collected from the tax increases over the next decade, from 2016 – 2025.

“Limit deductions for top earners to 28 percent rate, even if income is taxed at 39.6 percent: $603.2 billion

Impose a 14 percent one-time tax on previously untaxed foreign income: $268.1 billion

Impose a 19 percent minimum tax on foreign income: $206 billion

Modify estate and gift tax provisions: $214.4 billion

Change the taxation of capital income: $207.9 billion

Other increases from reform of U.S. international tax system: $135.8 billion

Impose a financial fee on large financial companies: $111.8 billion

Increase tobacco taxes and index for inflation: $95.1 billion

Repeal LIFO (Last In First Out) method of accounting for inventories: $76.1 billion

Conform SECA (Self Employed Contributions Act) taxes for professional service businesses: $74.6 billion

Other revenue changes and loophole closers: $47.9 billion

Eliminate oil and natural gas preferences: $45.5 billion

Implement the Buffett Rule by imposing a new “Fair Share Tax” (making millionaires pay at least 30 percent tax rate): $35.2 billion

Reform the treatment of financial and insurance industry products: $34.4 billion

Limit the total accrual of tax-favored retirement benefits: $26.0 billion

Other loophole closers: $24.3 billion

Reinstate Superfund taxes: $21.2 billion

Tax carried interests as ordinary income: $17.7 billion

Make unemployment insurance surtax permanent: $15.7 billion

Eliminate coal preferences: $4.3 billion

Reauthorize special assessment from domestic nuclear utilities: $2.3 billion

Increase and modify Oil Spill Liability Trust Fund financing: $1.6 billion

Repeal tax-exempt bond financing of professional sports facilities: $542.0 million”

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

Since we’ve been discussing it recently.

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

Obama has consistently talked about how he is for “tax reform” all during his presidency. But clearly, he has no idea what that even means. True tax reform is a mechanism that produces a cleaner and clearer tax code. A great example of this was the 1986 IRC reform, where Reagan set the highest rate at 28% in exchange for eliminating massive amounts of tax shelters and gimmicks.

Obama’s cluelessness on the topic was evident during the State of the Union, where, instead of the simplification that Obama likes to espouse, we got a myriad of proposals that will further clutter the tax code. You can’t say you are for tax reform and then present a speech filled with the very items that true tax reform would remove, such expanded child care tax credits and new community college initiatives.

It is these very type of policies that have made the tax code so byzantine. Essentially the government uses the tax code to pick winners and losers favoring some but not others such as married vs non-married, children vs non-children, education vs non-education. This is the essence of crony capitalism, where politicians trade favors and barters to support certain initiatives or restrict others via new taxes or credits. They’re basically all gimmicks to aid in reelection or pander to a portion of the electorate — and then we never get rid of all the tacked-on programs and policies because no one wants to give up their special initiatives. The code is immensely complex because of it.

The tax code should never be used in this manner. It’s either a proper tax or not — but you don’t put an item into the tax code and then restrict it to certain people and not others. If someone is making more money, they are subjected to higher tax margins. Fine. But you don’t then add on more crony restrictions or surtaxes to try to squeeze out extra revenue. If a policy is good for the middle guy, it ought to also be good for the wealthier guy — who is already getting dinged accordingly (“paying his fair share”) by paying higher tax rates.

Obama’s version of “tax reform” is unrealistic and firmly rooted in his vision of “middle class economics”. This means using the tax code to promote “fairness” by targeting the wealthy to pay for new spending programs and credits for others. That is not tax reform — that is wealth redistribution.

by | ARTICLES, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

President Obama just told the country during his State of the Union address that he is going to increase the capital gains rate again in order to raise revenue for new spending programs. Given that Obama already knows that raising the capital gains rate actually REDUCES revenue, we are left with a President who believes that we can pay for increased spending by reducing revenue. He acknowledged this in 2008 during a televised debate against Hillary Clinton, but went on to state that rates should be hiked – despite its effect of reducing revenue – because it was more “fair” taxation (ludicrous, but a subject for another day).

Extraordinarily and equally disappointing about this fundamental economic error is that no one in the major press outlets, on the day after the State of the Union speech, pointed out the President’s gaffe. Do we really have a President who pushes for paying for increased spending projects with policies that reduce revenue? Or do we have a President who puts forth an initiative that he knows has very little chance of realization, but chooses to do so anyway so he can characterize the Republicans as protecting the wealthy while he can claim to protect the middle class? And did he believe that the press was so clueless that they would not laugh at him the following day?

Capital gains are unusual in that the taxpayer has the ultimate decision as to whether and when to sell his asset (stock, his business, a work of art, etc.) The higher the tax rate, the LESS likely he is to sell, seeing as he will only be able to enjoy or reinvest what is left of the proceeds AFTER TAX. History has borne this out – capital gains tax collections go down in the periods after increases, and go up in the years after decreases.

The actual impact of raising the capital gains rate is also devastating to the economy. By discouraging the sale of assets, there is reduced capital available for new projects and opportunities, reducing job creation and wages, and resulting in lower revenue collection.

Furthermore, with higher capital gain rates, the expected after tax rate of return on new projects will go down, assuring that fewer of them will go forward.

Additionally, there are a number of localities, like the state of California and New York City, which have tax rates of 12% or more and also a large concentration of wealthy people and high performing businesses. Couple that with the proposed increase to the federal capital gains rate and you could see total capital gains rates of more than 44%, A capital gains rate this high would virtually bring elective capital to a standstill. This would amount to a rate more than twice the rate during the Bush Administration (15%) – when growth and the economy were very strong..

Raising the capital gains rate will put a stranglehold on risk taking and available capital. Why sell an asset to fund further investment and opportunity when the government takes a large share of the gain with the loss remaining all yours. It makes virtually no economic sense to do so, and the result means an already anemic economy will continue to struggle.

![bastiat-quote-picture_thumb[2]](https://taxpolitix.com/wp-content/uploads/2015/02/bastiat-quote-picture_thumb2.jpg)